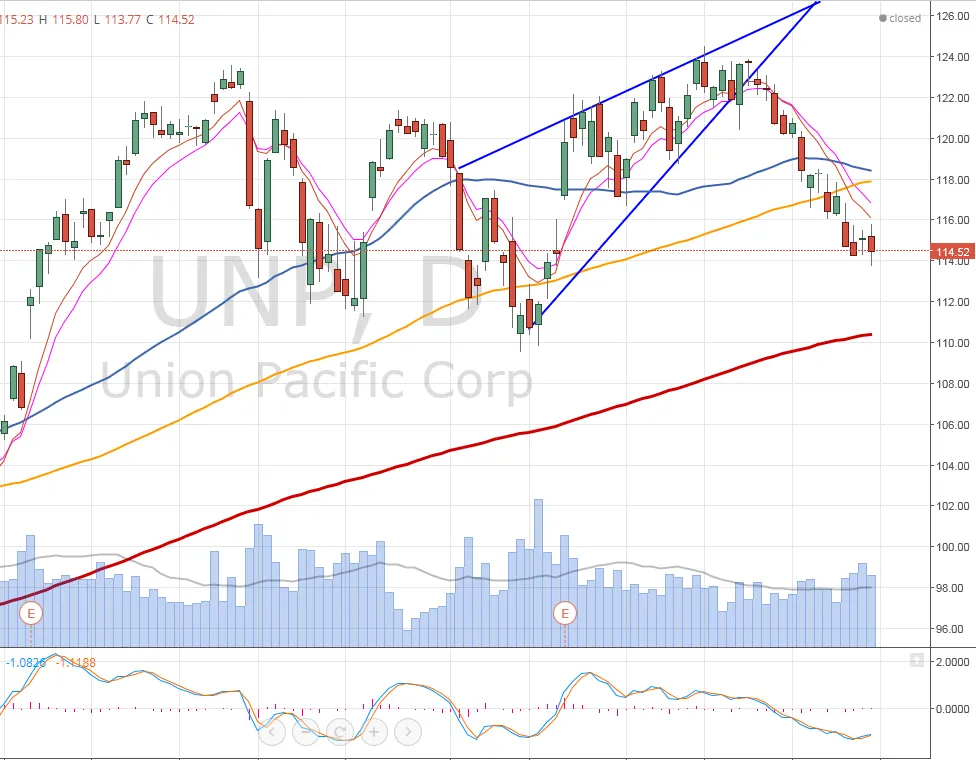

Rising Wedge Trading Pattern

Definition:

A Rising Wedge is a chart pattern within the context of an uptrend composed of two upward sloping and converging trendlines connecting a series of higher swing/pivot highs and higher swing/pivot lows.

Background:

The power of a Rising Wedge can be greater after a moderate upside move due to the possible decrease of underlying support as the pattern is formed.

Rising Wedges can be stronger when the series of higher swing highs and higher swing lows that formed the pattern narrow down into a point/apex as bulls become less interested in buying.

Practical Use:

Technical analysts will use Rising Wedge patterns as the beginning of selling opportunities, especially when in context with other tradable sell short setups. In addition, traders will often simply avoid further buying opportunities when they occur in the context of a rising wedge.

Get 6 (downloadable) trading tutorials emailed to you right now--FREE.

Real-life Chart Examples