Follow Us!

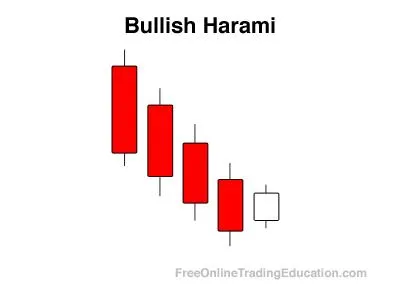

Bullish Harami Reversal Pattern

Definition:

The Bullish Harami is a two bar candlestick pattern that develops after a down leg. Each of the two candlesticks has an opposite color. After a sell-off in price, this pattern is formed when the real body of the second candlestick trades completely within the range of the real body of the previous candlestick.

Practical Use:

Technical analysts often use the Bullish Harami candlestick pattern as a signal to buy an asset. This is usually taken into context with another buy pattern for an added amount of confirmation.