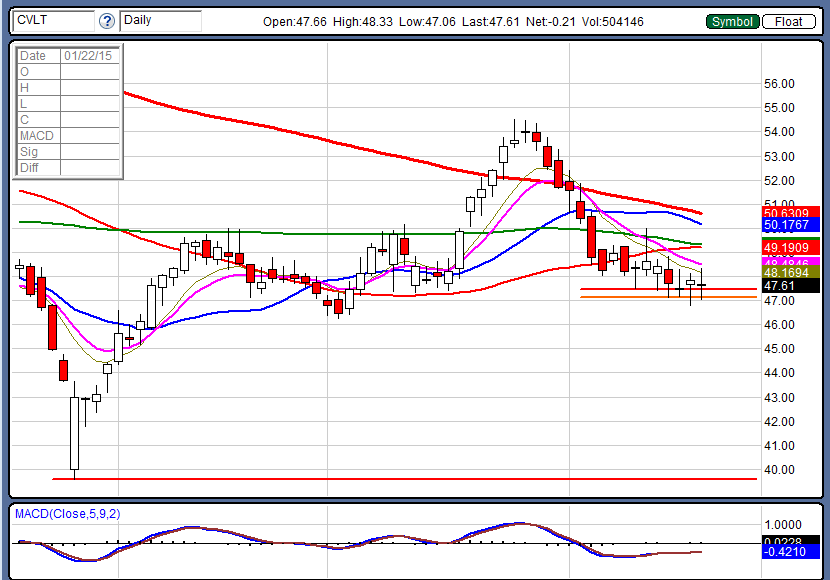

Low Base Breakdown Trading Pattern

Definition:

A Low Base Breakdown is when a price action within the context of a downtrend pauses at the bottom of a down leg and consolidates in a sideways fashion in a narrow range.

Background:

The power of a Low Base Breakdown can be greater after a powerful downside move due to the possible increase of overhead resistance.

Low Base Breakdowns can be stronger when the previous swing/pivot low is above a low base due to the possible lack of immediate underlying support.

Practical Use:

Technical analysts often seek out Low Base Breakdown patterns for their ability to signal a shift from buying (and/or selling short uncertainty) to selling pressure.

Get 6 (downloadable) trading tutorials emailed to you right now--FREE.

Real-life Low Base Chart Examples