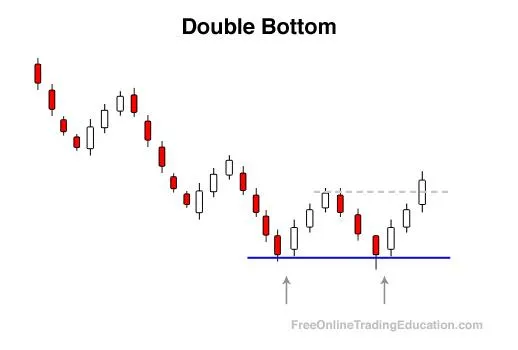

Double Bottom Reversal Pattern

Definition:

Double Bottom is when the price action within the context of a downtrend has the most recent swing/pivot low equal or nearly equal to the previous swing/pivot low.

Background:

The Double Bottom pattern can be formed when the sentiment that was formerly producing the downtrend is now possibly shifting and selling pressure is not strong enough to produce a lower swing high to keep the downtrend intact.

Double Bottoms can be a stronger upward reversal pattern after further confirmation when the next swing low that is produced is even higher.

Practical Use:

Technical analysts will use Double Bottoms to begin trying to find new buying opportunities as well as to avoid selling the asset until a new short setup is formed.

Get 6 (downloadable) trading tutorials emailed to you right now--FREE.

Real-Life Double Bottom Examples