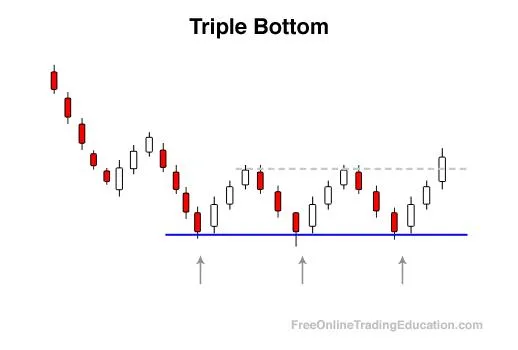

Triple Bottom Reversal Pattern

Definition:

A Triple Bottom is a typically longer term pattern where price action, within the context of a downtrend, has the most recent swing/pivot low being equal or nearly equal in price to the previous two swing/pivot lows that are also equal or nearly equal in price.

Background:

The Triple Bottom pattern can be formed when the sentiment that was formerly producing the downtrend is now possibly shifting and selling pressure is not strong enough to produce a lower swing/pivot low to keep the downtrend in tact.

Triple Bottoms can be a stronger bullish reversal pattern after further confirmation when the next swing/pivot low that is produced is even higher.

Practical Use:

Much like a Double Bottom pattern, technical analysts will use triple bottoms to begin trying to find new buying opportunities as well as to avoid selling the asset until a new sell setup is formed.

Get 6 (downloadable) trading tutorials emailed to you right now--FREE.

Real-life Chart Examples